Spectacular Info About How To Become A Cpa In Ga

Passed the uniform cpa exam;

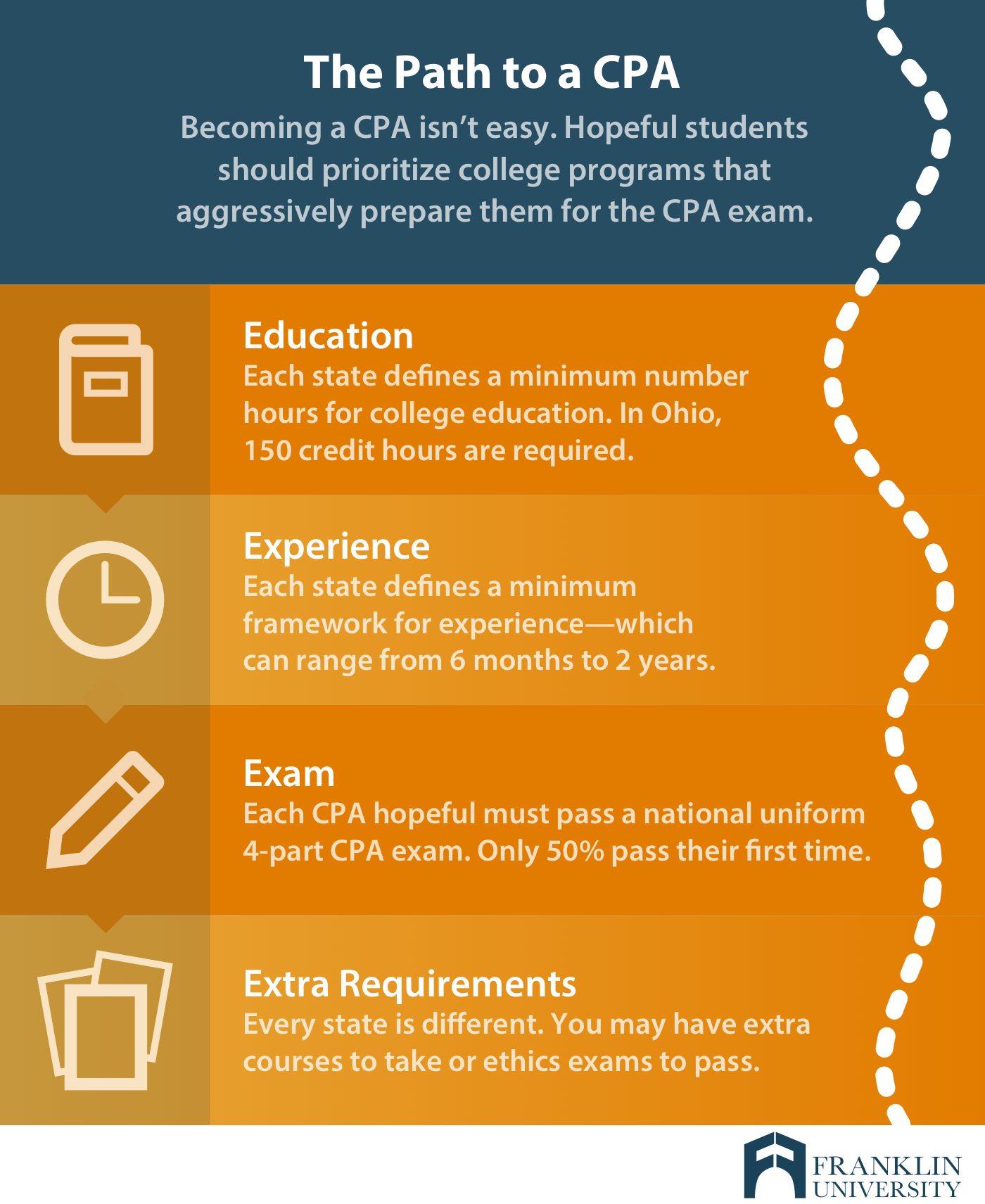

How to become a cpa in ga. For the full license, an additional 30 semester. Ad pass up to 4x faster with our adaptive technology. Pace & price vary—fees apply.

Save on a bs business w/ flexpath. Must include a minimum of 2,000 hours. You are eligible to apply for a cpa license in georgia only if they have:

Ad pass up to 4x faster with our adaptive technology. 150 credit hours in accounting and business; Ask for the georgia coordinator.

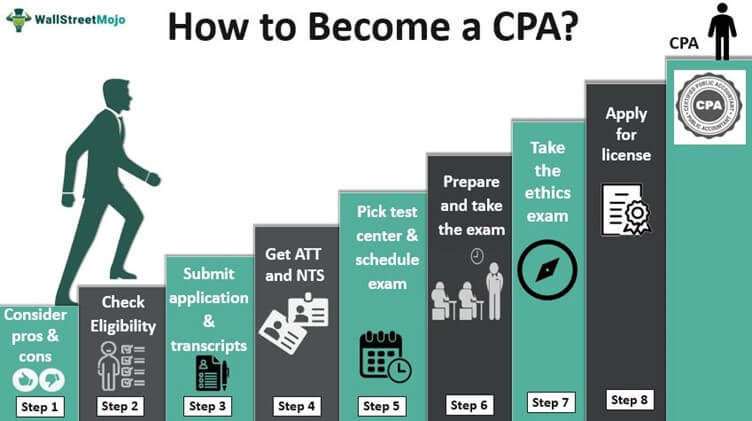

Learn the 7 simple steps to qualifying to become a licensed cpa in georgia: Meet the education requirements in georgia. Thank you for your membership with the georgia society of cpas!

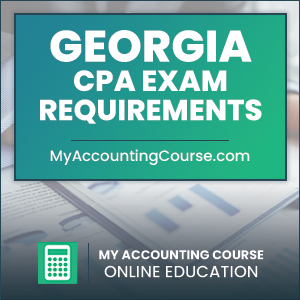

Learn about cpa eligibility requirements in the state of georgia on this page. Must submit certificate of experience to verify 1 year (2,000 hours) of supervised accounting experience no longer than 1 year prior to cpa licensure application. Click the button below to sign up for.

Requirements to obtain your cpa license: Pass all four sections of. Gain accounting knowledge to help you become a cpa with an online bachelor’s.

Ad fastest 25% of students. Must be completed not more than one (1) year immediately preceding the date of application. Please see individual license reinstatement below.

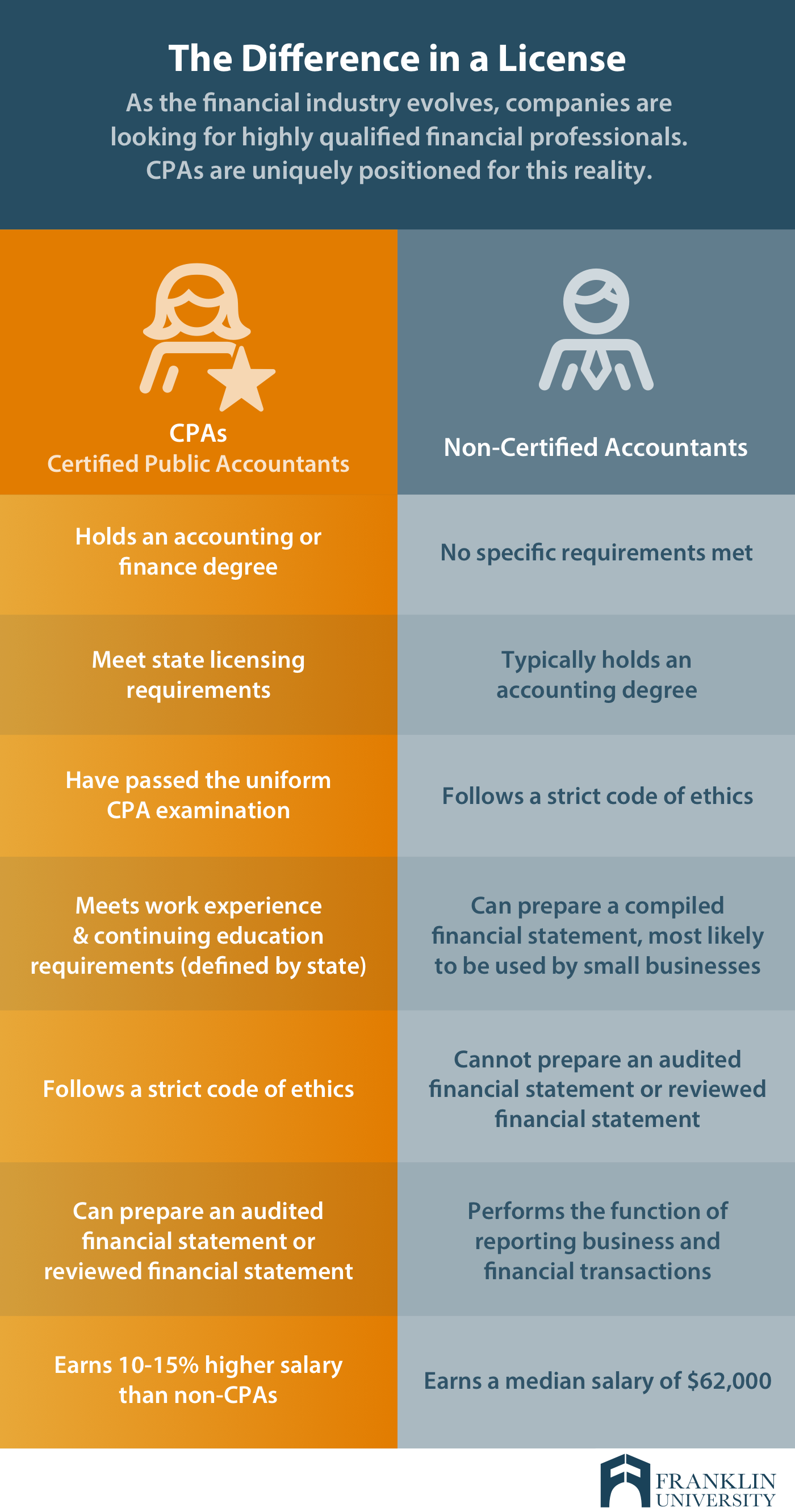

Ask for the georgia coordinator. Meet the eligibility and education requirements to sit for the cpa exam applicants who wish to be qualified to take the cpa exam will first need to pass Qualifying for licensure in georgia.

If your membership dues were renewed before the june 30th deadline you are qualified to receive a free registration to. To become a cpa (certified public accountant) and to sit for the cpa exam, you need to obtain a bachelor's degree and complete 150 semester. In order to be eligible to apply for cpa licensure in the state of georgia, applicants must meet the following requirements:

Accrued 150 semester hours of college; There is not anyone here at the board that evaluates education requirements for the purposes of taking the cpa examination or for licensure. To sit for the cpa exam, you will need 120 semester hours of undergraduate coursework that includes a specialty or major in accounting.

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-Eligibility-Criteria.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-License-Education-Requirements.png)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-License-Requirements.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-License-Requirements.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Experience-Requirements.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-Sections.png)